Posts By: admin

Warning that ‘warm water’ systems in apartment buildings pose legionella risk

George apartments, North Melbourne Photo: Google Maps

- – The Age Newspaper National

- Source: http://www.theage.com.au/national/investigations/warm-water-systems-in-apartment-buildings-a-legionella-risk

- December 4, 2016

Leading plumbers fear many of Melbourne’s new apartment buildings pose a legionella bacteria risk due to their energy-efficient “warm water” systems.

Mount Waverley’s big pit to be re-dug as developers’ plans are revised upwards

Around 16,000 cubic metres of dirt was dumped on the site after the collapse. Photo: Joe Armao

- – The Age Newspaper Victoria

- Source: http://www.theage.com.au/victoria/mount-waverleys-big-pit-to-be-redug-as-developers-plans-are-revised-upwards/

- November 22, 2016

The developer facing disciplinary action over the collapse of a major excavation pit is planning to bring the diggers back again after applying to construct an even larger building on the same site.

In July 2015, Jim Nicolaou of Action Master Builders was forced to fill a crumbling construction pit in Mount Waverley after the 15-metre deep hole he was digging collapsed following heavy rain.

Cutting Red Tape: Cause and Effect

- – Builders Collective of Australia

- Source: sourceable.net/cutting-red-tape-cause-effect-urgent/

- August 18, 2016

Much has been said in the past regarding the prospect of cutting red tape, and the defence is always there are cost savings that benefit home affordability. That may be the case on the surface but what is the real cost to the industry, and where are the impacts?

Government argues 95 per cent of consumers benefit from the removal of red tape, and only five per cent may be adversely affected. Yet the Chairman of the ACCC, Rod Sims, has now agreed privatization that underpins the removal of red tape has not worked. (more…)

Rangeview estate builder’s penalty reduced after his financial situation was taken into account by VCAT

MUST: Victim impact statements after Rangeview estate builder fined for breaches of prefessional standards

- – Leader News

- Source: Rangeview estate builder’s penalty reduced after his financial situation was taken into account by VCAT

- June 15, 2016

A NEGLIGENT builder who left families with hundreds of thousands of dollars in repair bills had his penalty reduced after a tribunal took his financial situation into account.

David Brayer, a director of company Statbay Pty Ltd, was the corporate builder contracted to build 69 townhouses at Diamond Creek’s Rangeview estate that are now riddled with defects. (more…)

How one of our worst builders left a trail of leaking roofs, toilets spewing sewage & unfinished jobs – and got away with it

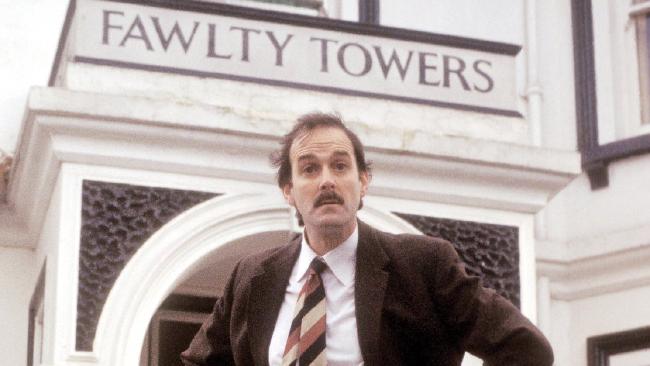

‘O’Leaky’ could be the worst builder since O’Reilly bungled Basil Fawlty’s renovation in Fawlty Towers. Picture: BBC

- – Sunday Herald Sun

- Source: How one of our worst builders left a trail of leaking roofs, toilets spewing sewage & unfinished jobs – and got away with it

- June 4, 2016

BURGLARS, vandals and car thieves worry people, which is fair enough. They’re the pests that do the regular mischief — so regular that insurance companies can rank the postcodes where they strike most. Live long enough and you’ll suffer from one or all of them, maybe more than once. (more…)

Disabled builder wins battle with Simonds Homes over faulty slab

Shannon Draper in front of the unfinished property. Photo: Luis Ascui

- Clay Lucas – The Age

- Source: Disabled builder wins battle with Simonds Homes over faulty slab

- June 4, 2016

Shannon Draper is a carpenter from Doreen. He’s on a disability pension. Simonds Homes, on the other hand, is one of the nation’s biggest home builders. Last year, the company earned $634 million in revenue. So it can afford to hire top lawyers when things go wrong. (more…)

“Incompetent” Rangeview estate builder David Brayer fined and stripped of building licence

Rangeview estate townhouses in Diamond Creek pictured during the construction phase in 2011. Little did those who bought the properties know what they were getting into.

- Brittany Shanahan – Diamond Valley Leader

- Source: “Incompetent” Rangeview estate builder David Brayer fined and stripped of building licence

- February 4, 2016

A NEGLIGENT and incompetent builder has been found guilty of breaching professional standards following a six-month investigation by the Diamond Valley Leader.

David Brayer, a director of company Statbay Pty Ltd, was the corporate builder contracted to build 69 townhouses at Diamond Creek’s Rangeview estate that are now riddled with defects. (more…)

NT insurance scheme for home building not protecting the industry, consumers say

- Katherine Gregory

- Source: ABC News – Pressure mounts to scrap mba insurance scheme for home building

- November 30th, 2015

Pressure is mounting for an insurance scheme for home buyers to be scrapped after the Northern Territory Government received numerous complaints from the people it is designed to protect.

Key Points

Master Builders Fidelity Fund launched by NT Government in 2013

Consumers and builders complain the fund fails to protect home buyers and is locking builders out of the market

Review recommends scrapping the fund for a public warranty scheme

Master Builders denies it is failing to protect consumers

Geraldine Want said she and her husband lost their dream home and life savings after the home they built was riddled with defects.

Ms Want said she and her husband eventually left the Northern Territory after losing a court battle against their builder in 2013, and he refused to fix the defects on their partially completed home.

She said they asked the newly created Master Builders Fidelity Fund to help cover the costs of fixing the defects and their legal fees, but it was beyond the scope of its indemnity cover.

Ms Want said their case showed home buyers and consumers do not have enough protection in the Northern Territory.

“Consumers need protecting not just from builders who go bankrupt or disappear but from builders who are only interested in your money not the house that has been promised,” Ms Want said.

This is one of many stories from home owners and buyers that influenced the Minister for Lands and Planning to initiate an independent review into the building industry.

“Over the years I’ve had a number of concerns raised with me about the Building Act and a big part of that was concern with the fidelity fund,” Lands and Planning Minister Dave Tollner said.

The Master Builders Association Fidelity Fund was established in 2013 and is the only form of insurance for the Territory’s residential building industry.

We’re not looking at scrapping the fund.

Dave Tollner, NT Minister for Lands and Planning

Builders apply and pay for a fidelity certificate, which allows them to build dwellings or extensions worth more than $12,000.

It is a ‘last resort’ scheme, which means consumers also pay into the fund to get protection if the builder goes bankrupt, dies, disappears, or loses registration before the home is completed or defects are fixed.

But Mr Tollner said the fund had limited payout capacity, and was limited in the ways it could protect people.

In response to these concerns, Mr Tollner established the Cureton Review, led by lawyer Cris Cureton, to examine the effectiveness of the Fidelity Fund scheme.

One of the review’s recommendations was “to establish a new, public model, residential warranty scheme to replace the Master Builders Association Fidelity Fund Scheme.”

“We’re not looking at scrapping the fund,” Mr Tollner said.

“What Cureton has proposed is that fund isn’t a mandatory part of building a house, so if people want to get insurance, they can access that insurance through the fund or another organisation that provides it,” Mr Tollner said.

Master Builders Association’s executive director Dave Malone said neither he nor the trustees from the Fidelity Fund would provide an interview to the ABC.

But in a written response to the review, Mr Malone said the entire building industry would be “impacted were the recommendations released by Minister Tollner to be implemented”.

“We have met with Cris Cureton (last Friday evening) and we are seeking to have him and the department explain the rationale to our members in a series of briefings for them,” Mr Malone said.

Fidelity Fund the subject of multiple complaints

Several small builders have spoken to the ABC about their concerns with the Fidelity Fund, but most of them wanted to remain anonymous because they say they are concerned about repercussions from the fund.

One of those builders said he felt victimised by the Master Builders Fidelity Fund, after not being able to obtain any certificates to build.

“It’s had a huge effect on us. It’s brought us back from building 30-40 houses in a 12-month period to realistically being told we can’t build any,” the builder said.

“The cashflow has been diminished to next to nothing. It’s running on the back of me having to sell properties to keep business afloat. It also means me having to lay off large amounts of staff.”

He said he had not been given any reason or justification for being rejected.

The fund does not make up the rules. Everything the fund does is governed by statue and the fund’s Trust Deed.

Statement by Master Builders Fidelity Fund

“As far as from the builders standpoint, you put in your application and if they feel like giving you cover they’ll give you cover and if they don’t you’re left out in the dark.”

He said he was told “in no uncertain terms” by the fund he was “being a smart arse and I would never be able to build in Darwin again”.

Paul Winter, another Top End builder, had all his applications approved by the fund and had not been personally affected, but was concerned by what was happening to the industry.

“I don’t understand how a particular group can restrict or tell him how many houses he’s allowed to build in value annually,” Mr Winter said.

“I think that’s a total restriction of trade,” he said.

He also said the fund was not protecting consumers against fraud, which was the majority cause for builders going bust in recent years.

“We brought in an insurance policy to protect the consumer, but the three triggers don’t allow for fraud. So where is the protection?” Mr Winter said.

The Master Builders Fidelity Fund denied allegations that consumers had complained about the fund and that it was victimising builders.

“The fund is aware of a small minority of builders that are disgruntled. The vast majority of builders in the industry support the work of the fund in protecting consumers.”

In response to questions about whether the fund’s cover was too for limiting consumers, the MBA’s statement said:

“The fund does not make up the rules. Everything the fund does is governed by statue and the fund’s Trust Deed.”

Reform in the Northern Territory

Builders across Australia pour hundreds of millions of dollars in to State And Territory Governments for them to provide consumer protection to our clients, but these funds are wasted and consumers suffer as well as our industry management.

The NT Giles Government have demonstrated their understanding of the building industry through the “Cureton Review” final report, that will see appropriate industry management and consumer protection (Cureton Review final report below).

Minister David Tollner’s press release at this link: http://newsroom.nt.gov.au/mediaRelease/16938

They have developed a holistic system of consumer protection and industry management we endorse, and includes:

- A one stop shop

- A Statuary warranty Fund to be administered by Government

- All contractors to be registered

- Registration will include financial assessment and access to the statuary Fund

- Registration period of 3 years

- Payment protection for subcontractors

- Reduction in red tape

- Both Low-Rise and Hi-Rise Residential properties are included in the new system

I believe this document is vitally important as it encompasses all the concerns we hold for the reform of the system here in Victoria and New South Wales.

Update on Mount Waverley building site

- Source: monash.vic.gov.au/About-Us/News/Update-on-Mount-Waverley-building-site

- September 4, 2015

It took nearly four weeks, about 2,000 truck deliveries, and about 16,000 cubic metres of fill.

That’s what was needed to backfill the hole at the Mount Waverley building site where there were landslips in mid-July. Backfilling of the site (on the corner of Highbury and Huntingdale Roads) was completed on 1 September 2015.